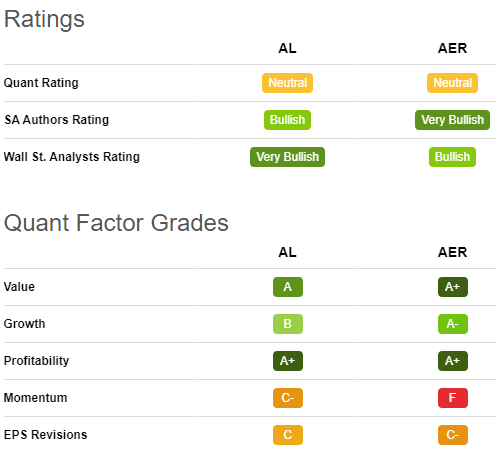

And the AVERAGE ANNUALIZED RETURN of 27% is also awesome over a 12 year period.Ĭlick Here To Get Your 14-Day Free Trial on Seeking Alpha Premium That chart speaks for itself! $185k vs $37k is a huge difference over a 12 year period. This is a backtest of investing $10,000 in the “Strong Buy” Quant-rated stocks on Januthrough the first half of 2022. The Wall Street Ratings are available to free members and the Quant and the Author Ratings are only available to Premium members. These ratings have proven to be valuable at predicting future performance. These ratings include a Quantitative Analysis Rating, a Seeking Alpha Author Rating, and a Wall Street Rating. In addition to all their contributed stock research, Seeking Alpha also provides a variety of stock ratings. But don’t worry, the Seeking Alpha team scrutinizes its authors carefully to make sure that they are credible and don’t have any conflicts of interest with the stocks they’re discussing. They have over 7,000 writers and publish 10,000 stock opinions per month. But this is no simple “message board.” Their posts are more like well thought-out research reports that are then reviewed by the Seeking Alpha editorial staff to make sure the content passes a quality review. stocks, ETFs, mutual funds, commodities and cryptocurrencies. This means that their users submit their thoughts and research on U.S. The Seeking Alpha platform is powered by information, ideas, research, analysis, and opinions crowdsourced from its users. Keep reading and I’ll tell you everything you need to know about Seeking Alpha Premium. See our ALPHA PICKS REVIEW to get more information about this service.Most significantly, one of their August 2022 picks was just acquired and that resulted in a 57% gain in just 6 months!.Seeking Alpha’s Picks include NUE (up 59%), MHO (up 61%) and AMR (up 28%). They are performing better than the Motley Fool’s Stock Advisor and Rule Breakers picks. After the first 8 months, they are delivering EXACTLY WHAT THE PROMISE. MaAlpha Picks Update: I’ve been a paid subscriber to Seeking Alpha’s Picks since their launch in July, 2022.If you just want a list of their 2 highest rated stocks each month, then you should consider their Alpha Picks service. Alpha Picks–This service is for investor who just want to be told what to buy.This review focuses on this Seeking Alpha Premium product. Seeking Alpha Premium–This service is for investors who want to research their own stocks, check on the rating of their stocks, and have access to ALL of research and reports on the Seeking Alpha platform.To be clear, Seeking Alpha offers 2 paid subscription products: If you want to buy stocks that are mostly likely to outperform the market and avoid those stocks that are likely to underperform, then YES, it is definitely worth it. So, Is Seeking Alpha Worth It?īased on the fact that their “Strong Buy” rated stocks have drastically outperformed the market by 5x, the answer is absolutely YES! That is a factor of 5x and an average annualized return of 27%. Here’s all you need to know: Since 2010, stocks that have had their highest “Quant Rating” have outperform the market by 5x.ĭo you see that? Investing in Seeking Alpha’s Strong Buy stocks would give you a $185,853 return compared to the S&P500’s $37,930.

So what is so special about this “Quant Rating”? It is their secret sauce! Twice a month they release a stock recommendation that has one of their highest “Quant Ratings.”

It is for people that don’t want to do their own research on stocks and would rather just be told what stocks to buy each month. Alpha Picks - This service is their stock recommendation service and makes picking stocks easy.This service is for those investors who want to do their own research.

AER SEEKING ALPHA FULL

Seeking Alpha Premium - This service allows you full access to all of their features, including the “Quant Rating” on any stock you choose.

AER SEEKING ALPHA FOR FREE

Like most sites, some of their information is available for free but the valuable information is only available to paid or Premium users. They currently have 2 paid products: Since their launch in 2004 they have become one of the most popular stock research sites with over 20 million visits per month. promotes themselves as “the world’s largest investing community powered by the wisdom and diversity of crowdsourcing.”

0 kommentar(er)

0 kommentar(er)